NAA, and a Coalition of Industry Trade Organizations Submit Joint Letter to HUD Regarding Construction Materials Noted in the Build America, Buy America Act

NAA and a coalition of industry organizations submitted a join letter to HUD to request HUD conduct a thorough assessment of the BAP’s implications on affordable housing providers.

April 15, 2024

Regulations Division

Office of the General Counsel

U.S. Department of Housing and Urban Development 451

Development 451 Seventh St., SW, Room 10276

Washington, DC 20410-0500

Request for Information Regarding Iron, Steel, Construction Materials, and Manufactured Products Used in Housing Programs Pursuant to the Build America, Buy America Act Docket No. FR–6433–N–01

Dear Sir or Madam:

We, the undersigned, are dedicated to addressing the critical housing needs of our nation and recognize the importance of ensuring affordable housing opportunities for all Americans. However, we face significant challenges in easing rising housing costs, preserving affordable housing stock, and facilitating the development of much-needed new housing supply. Our organizations comprise a diverse array of organizations spanning the housing sector, advocating for policies that promote equitable access to housing and address the unique needs of under-resourced communities. As stakeholders deeply invested in advancing housing affordability and stability as part of Department of Housing and Urban Development (HUD) programs, we appreciate the opportunity to provide input on the implementation of the Buy America Preference (BAP) authorized by the Build America, Buy America Act (BABA).

Our comments will describe the most common building products and materials used in new construction of single-family and multifamily housing, the most commonly imported items, and our lingering concerns about the potential unintended consequences for affordable housing production that may result from applying BABA domestic sourcing requirements to HUD’s affordable housing programs.

Materials Used in Housing Construction

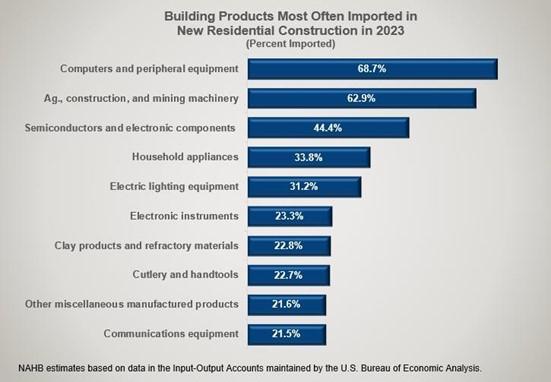

The National Association of Home Builders (NAHB) Economics Department conducted an analysis of Input- Output Accounts data from the U.S. Bureau of Economic Analysis (BEA) to identify the building products that would be most impacted by the BAP. The BEA data is available with a time lag, so the data was brought forward to 2023 using nominal percentage increases in the number of single-family and multifamily residential structure and imports of goods. The time-adjusted data shows close to $179 billion in products used in 2023, of which $13 billion (7.3 percent) was imported. Although the percentage of imports for many products and materials may seem relatively small, imports provide an important relief valve that can help avoid price spikes and input shortages that make it difficult to build housing—especially affordable housing.

The following chart shows the materials commonly used in construction of new single-family and multifamily housing. Some of the largest product categories are “plastic products”, which includes plastic piping, plumbing fixtures, and polystyrene foam insulation, and “architectural and structural metals”, which includes metal windows and doors, sheet metal ductwork, rails, and fencing [1].

Building Products Used Directly in New Single-family and Multifamily Construction: 2023 (in $Thousands)

| Product Category | Domestically Produced | Imported | Percent Imported | |

|

3341 |

Computers and peripheral equipment |

30,505 |

66,966 |

68.7% |

|

3331 |

Ag., construction, and mining machinery |

226,354 |

383,411 |

62.9% |

|

3344 |

Semiconductors and electronic components |

60,754 |

48,583 |

44.4% |

|

3352 |

Household appliances |

3,557,015 |

1,817,263 |

33.8% |

|

3351 |

Electric lighting equipment |

2,492,614 |

1,131,850 |

31.2% |

|

3345 |

Electronic instruments |

250,631 |

76,157 |

23.3% |

|

3271 |

Clay products and refractory materials |

1,853,203 |

547,542 |

22.8% |

|

3322 |

Cutlery and handtools |

791,192 |

232,410 |

22.7% |

|

3399 |

Other miscellaneous manufactured products |

171,954 |

47,270 |

21.6% |

|

3342 |

Communications equipment |

458,912 |

126,053 |

21.5% |

|

3353 |

Electrical equipment manufacturing |

997,455 |

241,601 |

19.5% |

|

3312 |

Products manufactured from purchased steel |

387,975 |

89,287 |

18.7% |

|

3262 |

Rubber products |

523,141 |

114,235 |

17.9% |

|

3253 |

Agricultural and basic chemicals* |

1,106,141 |

233,723 |

17.4% |

|

3313 |

Alumina and aluminum products |

31,913 |

6,565 |

17.1% |

|

3221 |

Pulp, paper, and paperboard |

13,231 |

2,626 |

16.6% |

|

3325 |

Hardware |

3,768,273 |

703,795 |

15.7% |

|

3211 |

Sawn lumber and treated wood products |

3,594,595 |

631,578 |

14.9% |

|

3359 |

Other electrical equipment and components |

4,861,178 |

791,770 |

14.0% |

|

3311 |

Iron and steel and ferroalloys |

649,653 |

94,540 |

12.7% |

|

3212 |

Plywood and engineered wood products |

8,294,806 |

1,165,989 |

12.3% |

|

3314 |

Other nonferrous metal products |

309,054 |

42,018 |

12.0% |

|

3279 |

Other nonmetallic mineral products |

6,312,118 |

752,378 |

10.7% |

|

3259 |

Other chemical products and preparations |

193,133 |

22,322 |

10.4% |

|

3329 |

Other fabricated metal products |

6,958,932 |

802,274 |

10.3% |

|

3326 |

Spring and wire products |

26,537 |

2,626 |

9.0% |

|

3222 |

Converted paper products |

2,145,459 |

207,462 |

8.8% |

|

3324 |

Boilers, tanks, and shipping containers |

742,893 |

69,592 |

8.6% |

|

3339 |

Other general purpose machinery |

3,095,264 |

278,367 |

8.3% |

|

3272 |

Glass and glass products |

480,863 |

27,574 |

5.4% |

|

3219 |

Other wood products |

7,527,945 |

424,116 |

5.3% |

|

3149 |

Other textile products |

861,468 |

39,392 |

4.4% |

|

3231 |

Printing and related support activities |

34,725 |

1,313 |

3.6% |

|

3334 |

HVAC & commercial refrigeration equipment |

6,343,420 |

232,410 |

3.5% |

|

3261 |

Plastic products |

13,764,505 |

471,385 |

3.3% |

|

3141 |

Textile furnishings |

286,102 |

9,191 |

3.1% |

|

3323 |

Architectural and structural metals |

16,114,889 |

491,081 |

3.0% |

|

3255 |

Paint, coatings, and adhesives |

4,716,180 |

137,870 |

2.8% |

|

3241 |

Petroleum and coal products |

11,835,994 |

280,993 |

2.3% |

|

3132 |

Fabrics |

123,009 |

2,626 |

2.1% |

|

3274 |

Lime and gypsum products |

2,014,998 |

28,887 |

1.4% |

|

3327 |

Machined products and screws, nut and bolts |

764,714 |

10,504 |

1.4% |

|

3273 |

Cement and concrete products |

29,051,339 |

154,940 |

0.5% |

|

3256 |

Soap, cleaning compound, and toiletries |

1,442 |

0 |

0.0% |

|

3315 |

Foundry products |

5,766 |

0 |

0.0% |

|

3321 |

Forged and stamped metal products |

109,780 |

0 |

0.0% |

|

3328 |

Coating, engraving, and heat treating metals |

589,813 |

0 |

0.0% |

|

3333 |

Commercial and service industry machinery |

1,492,644 |

0 |

0.0% |

|

3369 |

Other transportation equipment |

23,064 |

0 |

0.0% |

|

3371 |

Household & inst. furniture & kitchen cabinets |

9,986,195 |

0 |

0.0% |

|

3372 |

Office furniture and fixtures |

5,725,390 |

0 |

0.0% |

|

|

Total: all products listed above |

165,759,129 |

13,042,537 |

7.3% |

*includes a small amount of product category 3251 (basic chemicals). Source: NAHB calculations based on U.S. Bureau of Economic Analysis Input-Output Accounts data

Domestic Materials Sourcing and Manufacturing

Banning imported materials for housing projects using federal financial assistance (FFA) would increase supply shortages, leading to construction delays and higher expenses. Even though most building products are primarily domestically procured, there can be unforeseen supply constraints that add to construction costs and increase delays. Thus, maintaining access to international markets is essential for builders and developers to ensure timely and budget-friendly completion of their projects and mitigate cost increases in the face of reduced supply.

Recent industry surveys further highlight the importance of maintaining access to imports of iron and steel, construction materials, and manufactured products. In a recent NAHB/Wells Fargo Housing Market Index (HMI) report, 63 percent of respondents reported having significant problems with building material prices and 37 percent had significant problems with the availability and amount of time it took to obtain building materials [2]. This data underscores the ongoing concern of the industry about access to materials, even without the presence of a domestic procurement mandate.

Timing

Access to the product categories impacted by the BAP vary in response to global economic and political conditions that are largely unpredictable and can have immediate and long-term price impacts. Many product categories are already severely undersupplied and domestic sources cannot fully fill in the supply gap in the near term. Shortages such as these are cyclical and access to global markets helps to offset price volatility, but this market mechanism would be hampered by the BAP.

Furthermore, we remain unclear about how prepared domestic suppliers and distributors are to consistently verify products and materials as Made in America and what documentation from FFA recipients and subrecipients would suffice in the case of a HUD audit. Additionally, many of the undersigned represent subrecipients of HUD FFA and are concerned about differing documentation requirements across jurisdictions that will further increase their costs to meet varying BAP documentation standards.

Conclusion

In closing, we are gravely concerned about the possible unintended consequences of BABA on affordable housing production. Expansion of the Buy America Preference (BAP) established by BABA will disproportionately burden builders, developers, contractors, and state and local governments already grappling with the housing supply shortage. These added costs will strain the resources of state and local governments and their development partners, ultimately reducing the pool of firms participating in HUD programs and curtailing affordable housing production. We firmly believe that the forthcoming implementation across all HUD FFA later this year, as presently scheduled, will precipitate an inundation of questions from stakeholders, exacerbating delays in affordable housing projects nationwide. Therefore, we urge HUD to postpone implementation of the BAP for at least one year. During this extension, we request that HUD conduct a thorough assessment of the BAP’s implications on affordable housing providers and devise comprehensive technical assistance measures to help stakeholders navigate the transition leading up to full implementation. Additionally, we emphasize the importance of maintaining access to international markets to prevent supply shortages, construction delays, and increased costs, particularly in the ongoing housing crisis context.

Thank you for your consideration of the information provided. Please contact Marc Daniels with the National Association of Home Builders at [email protected] if you have any questions or would like additional information.

Sincerely,

Council for Affordable and Rural Housing

Habitat for Humanity International

Manufactured Housing Institute

Mortgage Bankers Association

National Affordable Housing Management Association

National Apartment Association

National Association of Home Builders

National Association of Housing Cooperatives

National Leased Housing Association

National Multifamily Housing Council

[1] Emrath, Paul. 2020. Building Products in New Residential Construction: What, Where, and Who. Washington, DC: NAHBEconomics and Housing Policy Group. A comprehensive breakdown of all product categories is available at the NAICS Code Drilldown Table.

[2] NAHB Economics and Housing Policy Group. 2024. Housing Market Index (HMI): Special Questions on Builders Challenges/Problems Faced in 2023 and Expect to Face in 2024. Washington, DC: NAHB Economics and Housing Policy Group.