U.S. Apartment Market

During the second quarter, the COVID-19 pandemic significantly impacted key apartment fundamentals as a result of stay-at-home orders and historical unemployment rates. Nonetheless, despite rapid changes to the multifamily housing sector, the downturn is expected to be short-term and offset by pent-up demand.

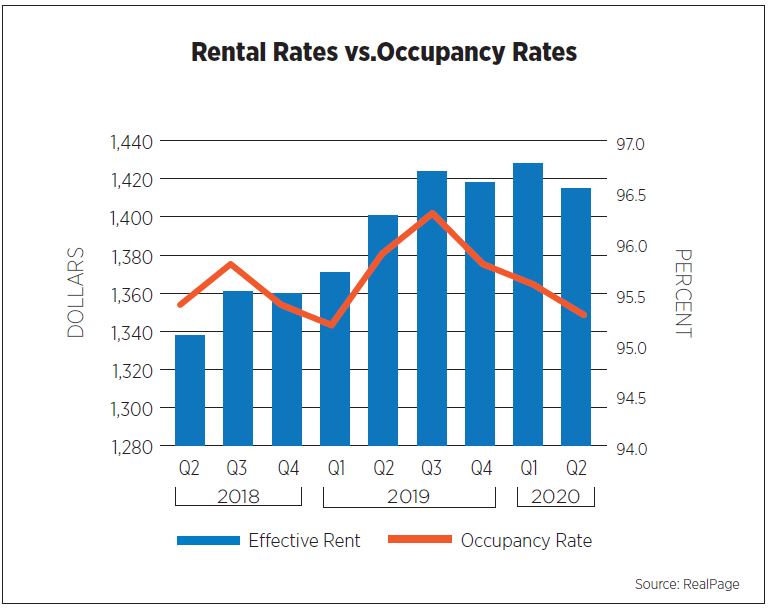

Occupancy rates fell to the lowest level since Q2 2017. U.S multifamily occupancy posted a decrease of 0.6 percentage points year-over-year to 95.3 percent, as reported by RealPage. Although vacancies increased because of job losses, resident retention has climbed to historically high levels. Many residents are choosing to shelter in place and renew in their current apartments. According to CoStar Group, among markets with 100,000 or more units, New York City, Sacramento, Northern New Jersey, Inland Empire and San Diego posted the highest occupancy rates.

U.S effective rent averaged $1,415, up by 1.0 percent annually but trailing the first quarter of 2020 by 1.0 percent, the first quarterly decline since 2010. Lower-priced suburban markets with limited new supply led the nation in rent growth. Given that remote work grants the flexibility to relocate, many renters are choosing affordability and more space over proximity to the office. As reported by CoStar Group, Inland Empire, Sacramento, Phoenix, Norfolk and Columbus ranked highest in rent growth.

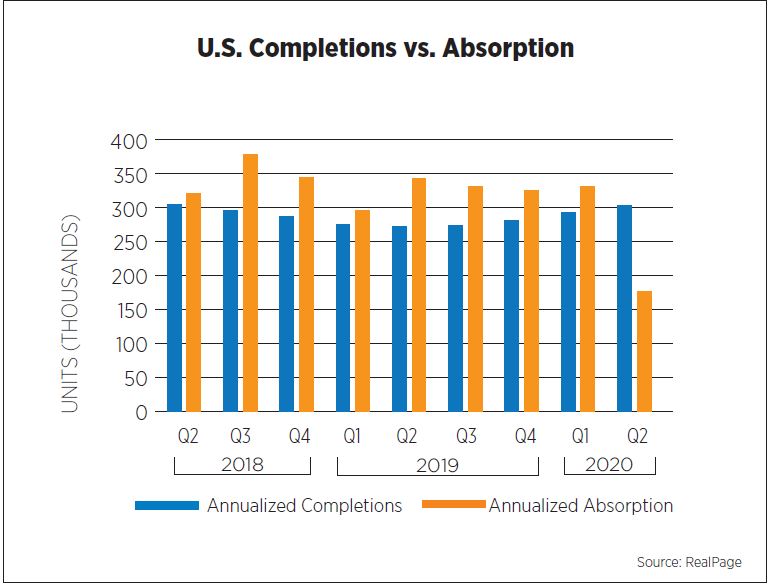

On an annualized basis, nearly 303,700 units came online during the second quarter, far outpacing demand. Apartment demand was significantly subdued; only 177,007 units were absorbed, the lowest level since Q3 2013. As the country shifts to reopening the economy, pent-up demand for apartments is likely to absorb new inventory. Dallas, Washington, D.C., Houston, Atlanta and Denver were the nation’s leaders for apartment demand.

New construction for apartment buildings battled interruptions brought on by the COVID-19 pandemic. Multifamily permitting totaled 368,000 units (seasonally adjusted annual rate) in June, declining by 15.2 percent since the same time last year, according to estimates by the U.S. Census Bureau. New York City, Seattle, Dallas, Houston and Austin were the top-ranking markets for multifamily building permits issued. Construction starts for apartments recovered in June after facing challenges in April and May. Apartment construction starts reached 350,000 units, down by 2.5 percent annually. The number of multifamily units under construction fell 4.8 percent to 654,000 units.

U.S. Capital Markets

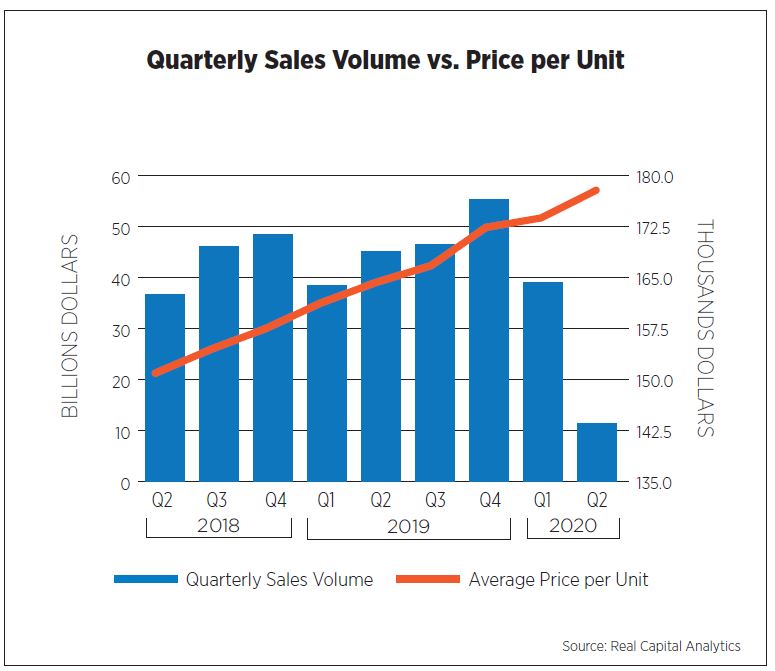

Investment activity in the apartment market was quiet during the second quarter as investors are choosing to take a wait-and-see approach. U.S. real estate deal activity has slowed across all property types; however, apartments remain the preferred asset. According to Real Capital Analytics, closed apartment sales transactions during Q2 2020 totaled $11.3 billion, falling to the lowest levels in a decade. Despite the pause in deal velocity, the average price per unit sold stood at $176,452, an annual growth of 6.5 percent. Investors traded more than 70,900 units, with cap rates averaging 5.3 percent, down 25 basis points compared to Q2 2019.

All major metros tracked by Real Capital Analytics posted a decline in sales volume. The largest decline in year-over-year quarterly sales occurred in Los Angeles, Houston and Seattle; each metro saw a drop in volume by over 80.0 percent. On the converse, deal activity in Denver and San Francisco experienced the least amount of interruption.

REIT and private capital was down marginally during the second quarter, declining by 2.9 and 2.0 percentage points, respectively, compared to 2019. Cross-border acquisitions of U.S. apartments increased by 2.6 percentage points, led by Canada and South Korea.

U.S. Economy

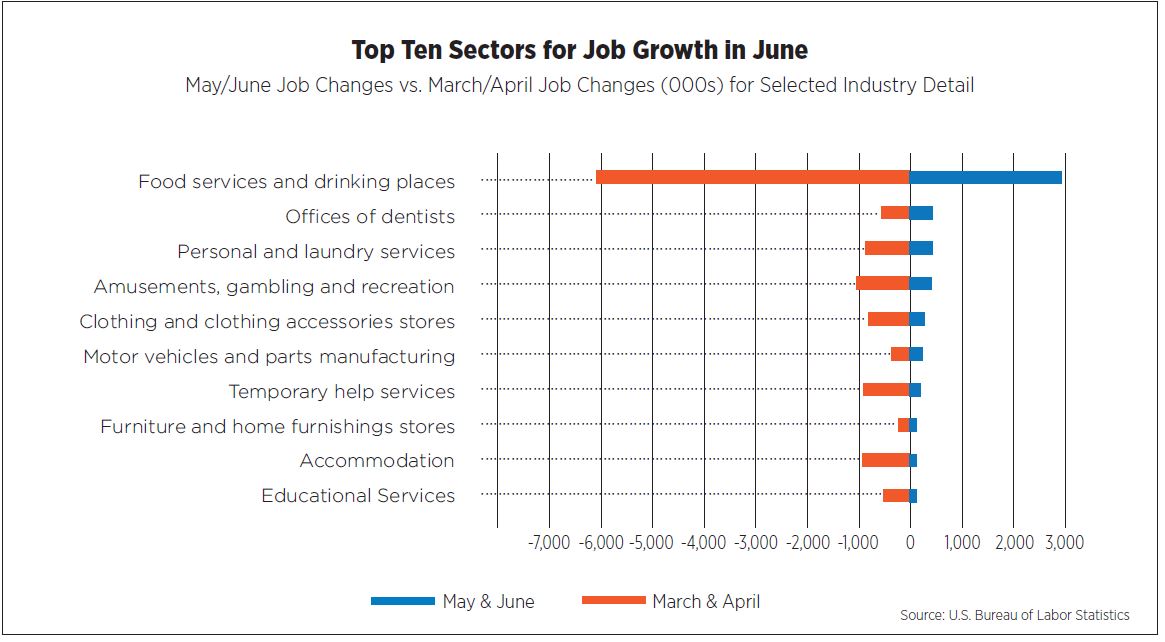

After experiencing its largest decline in history in April (20.8 million jobs), employment regained some ground in May and June, adding 2.7 and 4.8 million jobs, respectively. The leisure/hospitality, retail and education/health sectors were the big winners in June as restaurants, bars, shops and doctors’ offices opened and/or expanded their services. The Bureau of Labor Statistics’ Establishment Survey was based on the payroll period which included June 12, so the effects of the end-of-month surge of COVID-19 cases in states such as Florida, Texas, Arizona and California were not reflected in June’s job report.

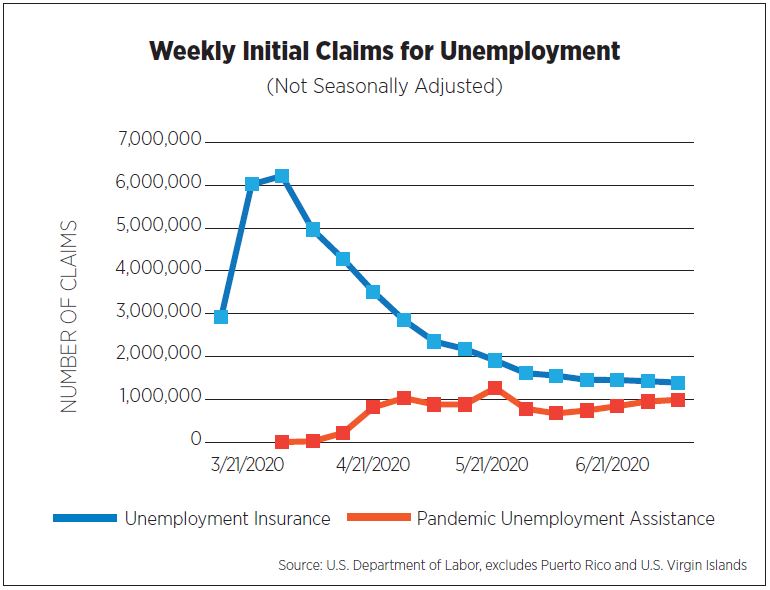

The closely watched weekly unemployment claims report painted a more troubling picture as it remained elevated at more than double the pre-pandemic level week after week. By July 4, initial claims for unemployment registered in the 1.4 to 1.5 million-range for four consecutive weeks. Claims for the Pandemic Unemployment Assistance Program, which covers workers not eligible for traditional unemployment insurance benefits, have been trending upwards since mid-June, totaling 1 million for the week ending July 4.

Personal income jumped 10.8 percent in April, thanks to stimulus checks and additional unemployment insurance provided for in the Coronavirus Aid, Relief, and Economic Security Act (CARES), before falling 4.2 percent in May. Still, on a per-capita basis, personal income remained 5.2 percent above pre-pandemic levels as the fiscal stimulus initiatives continued to make many workers more than whole.

In the face of uncertainty and an economy that may continue to struggle, consumers set aside money to cover potential financial hardships. The personal savings rate, which averaged 7-8 percent during the past several years, soared to 33 percent in April, the highest level since the data series began in 1959. It has since dropped to 23.2 percent in May as consumers began making purchases again, but remained elevated.

Forecasts for Q2 Gross Domestic Product (GDP) from selected sources range from a high of -14.3 percent annualized by the New York Federal Reserve Bank to -38.9 percent by The Conference Board, whose baseline forecast scenario is a Double-Dip Recession with unemployment rates staying above 9 percent through 2021. Moody’s Analytics is forecasting a 33.2 percent decline in GDP with unemployment rates falling under 9 percent by the end of 2021. The persistently wide ranges in forecasts highlight the uncertainty of a second wave of the novel coronavirus and the timing in which it might occur.

Outlook

With COVID-19 cases higher in some states than they were in April and May—originally anticipated to be the peak—the pandemic is far from contained in the United States. Until consumers and businesses alike hear some good news about containment, treatments and vaccines, fits and starts can be expected to plague economic activity.

Between consumers’ savings and additional income, it should come as no surprise that rent collections being reported by several property management firms for institutional-grade properties remained strong through July. But the combination of dwindling savings and the supplemental federal unemployment insurance expiring at the end of July bodes poorly for rent collections in September and beyond.