Brought to you by:

An uncertain global economy dogged by several headwinds, geopolitical disquiet in a variety of hotspots around the globe, and jittery financial markets in 2019 are a combination of factors that have set the stage for the new year. For commercial real estate investment, these trends could prove impactful in 2020, as the longest US economic expansion continues to chug along.

For CoStar’s Advisory Service team, newly joined by the premier hotel data and benchmarking firm STR, our response to widespread uncertainty is to stubbornly dig further into the data, synthesize actionable predictions for the year to come, and provide a solid dose of pragmatism. The following predictions are part of a 31 prediction webinar forecasting the negative, positive, and everything in-between for Multifamily, Office, Retail, Hotel, and Industrial in 2020.

The multifamily sector has held up well amid an ongoing supply wave, with vacancies nationally hovering near cyclical lows. Construction delays, caused by shortages in both labor and materials, have slowed the pace of deliveries, allowing markets to digest the new supply at a more manageable pace over the last couple of years. However, roughly 4.5% of multifamily inventory nationally remains underway today, and many of those projects that were delayed are now on pace to complete in 2020, leading to a rise in supply levels. The impact of deliveries will not be felt equally, as developers continue to favor high-end apartment construction in more expensive submarkets.

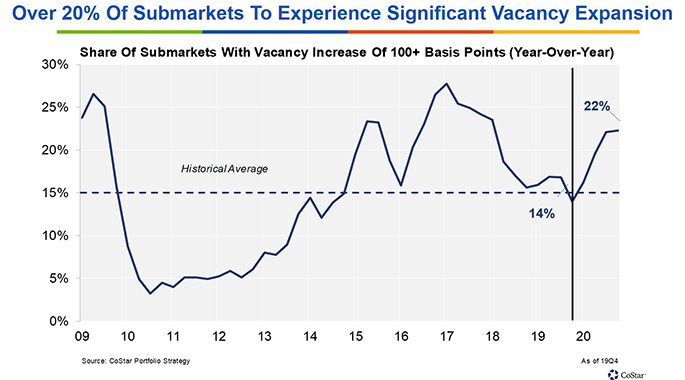

The escalation in the share of submarkets with significant vacancy increase projected in 2020 is largely a function of higher levels of supply, as projects that were delayed come on line, rather than weak demand growth. In this case, “significant” is defined as an increase of at least 100 basis points in the submarket’s unstabilized vacancy rate. In fact, many of the submarkets with a more substantial projected increase in vacancy tend to be supply-driven, including Downtown Seattle and Lake Union, and the Woodlands and Heights in Houston. However, a slowing in construction starts nationally could lead to a more modest pipeline in the mid-term, providing a relief valve from the supply pressure in many of these submarkets.

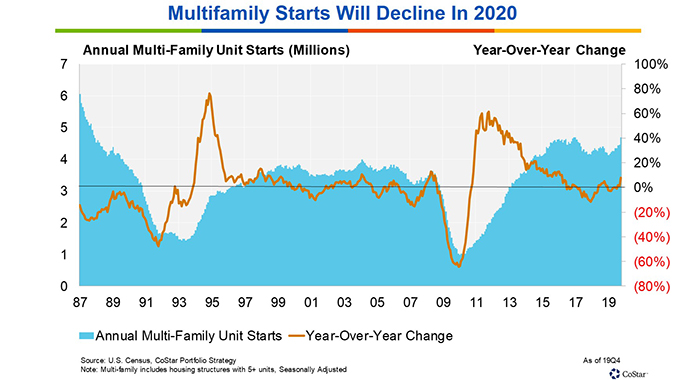

The previously mentioned construction decline stems, in part, from a slowdown in multifamily starts. This decline in starts will ultimately affect completions down the line and the CoStar forecast for supply in 2021 and 2022 reflects this. The usual culprits are to blame, as demand for construction labor outpaces supply. As labor has gotten more expensive, it is harder to justify development. As such, starts have flattened year over year, though we do see a minor uptick today. Nevertheless, we expect that those tight labor conditions will make themselves felt such that 2020 will have fewer 5+ unit housing starts than 2019.

This may allow the labor shortage in construction to ease a bit and could cause a resurgence in starts in a year or two, but for the short-term, we feel confident the scenario we’ve laid out will persist through much of 2020.

For more information about the full 2020 predictions webinar or to learn more about the custom consulting work of CoStar Advisory Services, contact Michael Cohen at [email protected].