Rental housing’s technological revolution has manifested a host of operational improvements, but what does it mean for the industry’s longstanding staffing models?

For as long as most industry leaders can remember, technological innovation has promised to change the way communities are staffed. Sales, marketing and operational tools have come to market to save time, remove friction and ultimately offer new ways to staff properties. While technology has undoubtedly improved operations, most properties are still staffed the same way. But in recent years, that has started to change.

The confluence of technology innovations like access control, AI leasing agents and prospect-centric (rather than property-centric) customer relationship management (CRM) systems are enabling self-service leasing. The lockdown phase of the pandemic provided a cultural jolt to an industry that had been relatively slow to adopt self-guided tours. With the technology widely available to enable a great self-serve leasing experience, it seems inevitable that the industry staffing model will change.

The changing impact of technology on operations has been a recurring theme in each of the last four editions of 20 for 20, an annual report on multifamily operations and technology. This year’s survey asked the 20 senior executive interviewees about the staffing model of the future, and their responses reveal the adoption of technology-enabled staffing models and the changes that the technology can bring to the nature of property management roles and career paths.

What Is Meant By Centralization

“Centralization” is a buzzword in the rental housing industry right now, meaning to take functions traditionally performed by team members assigned to individual properties and doing them instead in

a centralized location. For example, to centralize leasing, a company might coordinate lead-nurturing centrally and share leasing agents between properties in a submarket.

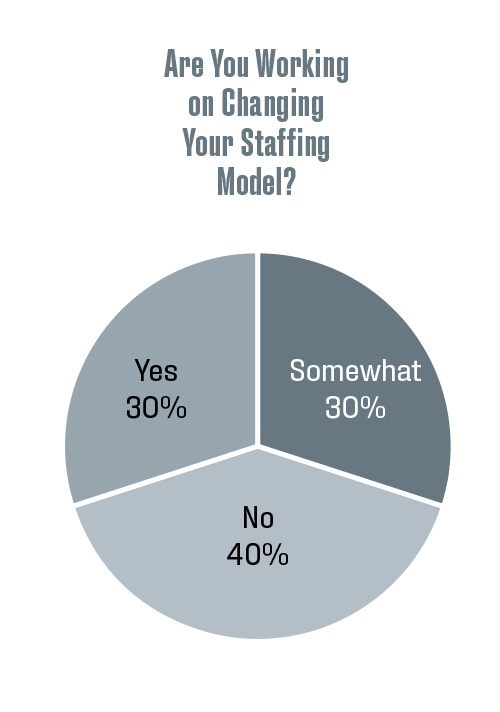

Several companies—including public REITs—have been organizing leasing this way for some time, with some announcing that their centralization has enabled them to break the one-staff-to-100-units ratio that has been a feature of multifamily since time immemorial. When asked if they are working on changing their staffing models, 60% of the 20 for 20 interviewees reported that they were either changing or exploring changing their staffing models (see chart below).

The approaches to centralization vary substantially according to two things: The extent to which a company controls its operating environment, and the submarket density of its portfolio. Public REITs, for example, have complete control over operations and technology decisions and usually have a lot of communities in the same markets. These are ideal conditions for centralization, but they do not apply to most companies in an industry as fragmented and diverse as multifamily.

LCOR, Inc. is a fully-integrated owner-operator specializing in large-scale, mixed-use developments along the East Coast. Mike Hogentogler, COO of LCOR, said, “It’s desirable to have our best leasing agents serve as many prospects as they possibly can. In the traditional model, property-based agents are busy when there are many units to sell and less so when there are few. When leasing agents are successful, they leave themselves with fewer apartments to lease. A better model would deploy the most successful leasing agents wherever we have exposure within a given submarket.”

LCOR’s commitment to change its approach to leasing led it to recently change its CRM platform. While the technology will make leasing more flexible, the nature of portfolios places some limitations on centralization. “If you are trying to get central teams to lease-up multiple properties, they need expertise in a specific geographical location,” said Hogentogler. “That’s easier to justify the more units you have to lease in a given submarket.”

Evolution, Not Revolution

The companies with both high submarket density and high levels of control over operational decision-making form a relatively small segment of the industry. Most companies have more diffuse portfolios and more diverse financial stakeholders to consider. But that does not mean that they cannot benefit from this trend.

Mike Brewer, COO of Atlanta-based owner and third-party operator RADCO Residential, is a long-time advocate for simplifying property management roles. “Historically, we [multifamily] have been in the habit of asking our property teams to be good at too many different things. It makes property management roles more complicated than they need to be, and in some cases, leads to a suboptimal career path.

“For example, we promote leasing agents to assistant property manager roles that include a lot of bookkeeping. That may fit the property’s needs, but it’s not a logical fit for the associate’s skillset or development,” he said. To solve this problem, RADCO, like a growing number of property management companies, removed accounting functions from prop- erty operations to a shared service model.

“We found that centralizing finance has led to a win-win of greater efficiency and a greater focus on the things that we’re asking properties to do well,” Brewer said. “Overall, it delivers a better associate experience, which is a big driver of many of the operational decisions that we’ve made at RADCO over the last few years.”

RADCO’s approach is a good example of an important nuance in this conversation: Centralizing activities does not need to mean centralizing roles. It is essential to focus not only on the work that property teams are doing, but also on how technology will change it.

In discussing the outlook for centralization, Tim Reardon, COO of NMHC Top 50 owner-operator, Bridge Property Management, said, “Understanding the true opportunity is not as straightforward as it may appear on paper. The technologies that we are considering are intended to put hours back into the site teams’ days, but taking items off of site teams’ plates doesn’t necessarily equate to time saved, more productivity or value created.”

Any time new technology or processes are introduced, there is some degree of uncertainty about the outcome. “Not only must we be convinced that the solutions work the way that we expect, but we also need to know that the result is actually beneficial,” said Reardon. “Lessening a workload may be an obvious result, but if that reduced workload doesn’t create tangible financial benefits, whether through direct or indirect pathways, what positive effect are you creating?”

The Rise of AI Leasing

Of all time-saving technologies, the one whose adoption appears to be growing the most quickly based on the 20 for 20 survey is AI leasing agents. It is important to delineate between this technology and similar ones. Chatbots—which are also popular—are usually website tools that serve up information interactively and are primarily marketing tools. AI leasing agents are natural language processing applications that handle inbound calls and nurture them through to booking a tour—work that leasing agents traditionally do.

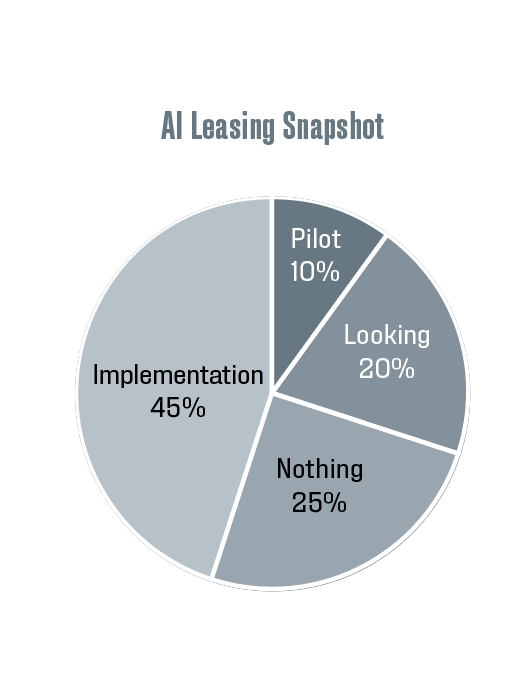

In a year when leasing tech has generally been a big story (it was the top technology priority for 20 for 20 interviewees), AI leasing was the area that witnessed the biggest growth (see chart below). Almost half of the respondents said that their companies were at some stage of implementing AI leasing, only a quarter of respondents were not doing it, and the rest were either piloting or looking to pilot the technology.

Two years ago, 20 for 20 predicted the rapid growth of this technology. At that time (late 2019), two of 20 interviewees had implemented AI leasing, but with its strong value proposition, relatively easy implementation and multiple vendors and client successes, it seemed ready to flourish in 2020. Of course, events took an unpredictable turn, but the remarkable uptick in adoption in 2021 suggests a technology whose time has come.

Curiously, despite the rapid adoptionof AI leasing agents, there does not yet appear to be a consensus on the specific problem that the technology solves. Some respondents see it as a key component of a centralized leasing model. Others see it as a way to avoid missing calls while lightening the load on property teams. But once again, savvy operators seem to be thinking about how the technology can improve existing property management roles.

Tracy Bowers is the Executive Managing Director for RangeWater Real Estate, an operator whose rapid growth saw it enter the top 20 of the recent NMHC Top 50 list. Bowers said of RangeWater’s experience rolling out AI leasing across its portfolio, “As our portfolio has continued to grow in unit count and geography, AI leasing has become a welcomed necessity in delivering a consistent and immediate experience to our potential residents.

“Tools such as AI leasing enable our team to prioritize other hospitality-centric skills, no longer choosing between answering the phone or opening the door. The AI answers every call immediately, guiding it through the sales funnel appropriately, improving overall conversion and delivering a better experience for prospects and associates.”

The Expanding Scope of Centralization

Leasing and back-office are not the only roles that have the potential to be improved by technology. A few of the larger 20 for 20 participants are working on taking a campus approach to maintenance, with new technology enabling the change.

Centralized coordination allows operators to triage maintenance issues, dispatching maintenance technicians or suppliers to the highest-priority jobs. Access control removes the friction from getting them in and out of units and buildings. Leak detection, thermostats and an ever-growing range of new sensors designed to diagnose maintenance problems promise to make companies smarter about allocating maintenance resources.

The recent acquisition of SightPlan by SmartRent is a good example of the deepening integration between the technologies that control buildings and organize maintenance activities. It is a source of innovation that should yield new efficiencies and—there is reason to believe—better jobs.

Pooling resources between properties and using technology to organize the work smooths out peaks and troughs in the regular cadence of property management work. The peaks and troughs exist because the conventional multifamily staffing model is rooted in a coverage model that predates the technologies described in this article.

Allocating individual associates to properties used to be the only way to deliver critical functions like leasing, bookkeeping and maintenance. The coverage model became enshrined in property P&Ls and proformas and baked some inefficiency into property staffing. Many operators now see this inefficiency as a performance opportunity, but consideration should also be given to the upside in associate experience, irrespective of whether or not staffing models change.

Perhaps the most significant benefit of this confluence of technologies lies in role specialization. The best leasing agents can do more selling and advance their careers in selling or service (without the detour into bookkeeping). Property management can focus on delivering the experience rather than admin or phone coverage. Maintenance teams can focus more of their time on the areas of highest impact.

At a time when staff shortages are paramount in planning and execution (another 20 for 20 finding), the industry should consider this opportunity. Centralization of tasks allows associates to do more of the things that they do well. And that provides a solid foundation for more fulfilling careers.

Dom Beveridge is Principal with 20 for 20, a multifamily technology consultancy.