Best Practices: Multifamily Debt Collections

With the number of lost collections increasing year over year, aggressive recovery procedures have become a hot topic with apartment owners across the nation. An average of $92 per U.S. apartment unit is lost annually to collections, according to the 2018 National Apartment Association Income and Expense Survey, which examined data reported for 2,967 market-rent properties containing 807,810 units and 511 subsidized properties containing 83,697 units.

The standard national recovery rate for debt collection agencies ranges from 20% to 15%, with corresponding recovery rates for affordable housing, housing authorities and poverty submarkets sometimes lower than 10%. Recovery rates depend, as well, on factors other than whether the property is classified as market rate or affordable; namely, the community’s class ranking, the timeliness of the collection submission and the time of year of the submission. Possessing accurate and complete documentation to legally pursue a former resident also increases the recovery rate.

The objective of this document is to outline best practices in the collection of bad debt or monies owed to an individual property or property owner. Although this paper doesn’t provide specific instructions on how to recover a debt, it is intended to serve as a guide as you review your company’s particular debt collection policy. Collection best practices are intended to assist with all efforts to pursue payments of debt owed by individuals. A well-crafted collection policy will maximize operational efficiency and ensure that owners and managers are recouping all funds owed by past-due residents. This information can be used both to reduce bad debt and increase overall recovery.

Contents

- Phase I: Collection Standards

- Phase II: Five Collection Steps

- Phase III: Early Move-Outs

- Phase IV: Partnering with a Collections Agency

- Phase V: Recovery Expectations

- Phase VI: Improving Results

- Sources & Additional Resources

Phase I: Collection Standards

It’s important to defend and support your debt collection practices by having clear and documented procedures for property managers. From gathering information during the resident application process to assigning debt after the move-out inspection, accurate documentation is critical in avoiding inconsistencies. Always remember that every communication and situation should be treated as if it could end up in court. Your team should be routinely educated about your policies to ensure compliance, consistency and optimal efficiency.

Consider the following while navigating collections:

Provide the previous resident with a final account statement within the time allowed by the state. This provides official notice that an amount is owed, a prerequisite for sending the debt to collections. It’s recommended that the resident participate in the final walk-through to better understand the move-out charges and address any potential issues at that time.

Review the resident file for completeness and accuracy. Any inconsistency in balance, or relative documentation, can impact recovery. There are numerous attorneys around seeking former residents, hoping to discover an unsupported fee or charge. These discoveries have resulted in five-figure settlements and/or defense fees—in some instances resulting in expungement of debt.

When an account is placed in collections, send all relevant documentation to your agency to increase the recovery chances and cut down on future requests. Include a signed lease, lease addendums, guarantor agreements, move-in/move-out inspections, repair invoices and all other applicable paperwork. It is also recommended to send recent contact information to include address, phone number and email on file to improve the likelihood of making immediate contact with the resident.

Review the account and address any concerns from the former resident about the debt owed, including any complaints against the landlord regarding habitability or service. It’s also important to alert the agency of prior disputes, attorney representation or bankruptcy when the account is placed.

Add in final utility statements, which may be a month late, and additional rent (if applicable) to ensure total amount owed does not require later adjustment. It is recommended to make note in the event future rent is being charged to revise rent amount owed if apartment has re-rented prior to the end of the responsibility period.

Phase III: Early Move-Outs

When a resident decides to vacate an apartment prior to the lease agreement end date, special considerations should be made to collect any fees or debt the resident owes. The following information will help ensure compliance to prevent litigation issues during the collection process

- The lease agreement should clearly explain the resident’s options for terminating prior to lease end. Options may include legal terms listed below in glossary.

- Options should include paying rent until the unit is re-rented or incurring a lease-break fee.

- The lease-break fee may be limited or capped as governed by state statute.

- To help prevent later disputes, secure in writing the option the resident has chosen for early lease termination.

- If the resident doesn’t select an option (or skips), more than likely a lease-break fee won’t be applicable and liquidated damages should be charged.

- If the resident chooses to pay until the unit is re-rented, the property manager must make a clear attempt to re-rent the unit, not just allow it to sit empty until the end of the lease. Also, the resident shouldn’t be sent to collections until that unit is re-rented and the final balance is accurately calculated in the account.

Glossary of legal terms pertaining to resident move-outs

Liquidated damages are damages that are uncertain or difficult to quantify at the time a contract is entered. Parties to a contract use liquidated damages where actual damages, though real, are difficult or impossible to prove when a breach of contract has occurred. Liquidated damages must be reasonable and in proportion to the actual harm incurred and cannot be assessed as a penalty.

A Lease Buy Out occurs when the landlord and resident mutually agree to terminate the lease contract. Both the landlord and resident should negotiate a lease buyout fee. Once the Lease Buy Out has been completed, the resident is no longer responsible for the obligations due under the lease contract.

Accelerated rent refers to when the landlord demands, upon a default by the resident, that the resident pay the entire balance of the unpaid rent owed under the lease contract for the remainder of the lease term in one lump sum.

Duty to mitigate refers to the duty of someone who was wronged to make reasonable efforts to limit the resulting harm. A duty to mitigate can apply to the victim of a tort or a breach of contract. Neglecting a duty to mitigate precludes the recovery of damages that could have been avoided through reasonable efforts.

Phase IV: Partnering With a Collections Agency

With the constant changes facing the apartment industry, keeping up with regulations can be increasingly difficult. Partnering with a third-party collections agency that includes a corporate compliance officer, inhouse legal counsel, and, often, a technology platform for collections data specific to your portfolio will help you adhere to these ever-changing regulations and decrease your company’s liability due to a misinterpretation of the law. Another advantage of using an agency is that doing so frees your property managers to focus on their many daily responsibilities while the agency concentrates 24/7 on collections.

Typically, hiring a collection agency involves no up-front costs and requires no payment until past-due monies from a previous resident are delivered (on average, 20 percent to 40 percent of the amount collected). A third-party collection agency’s sole purpose is to focus on recovering past-due accounts, so the more quickly you place an account with an agency to be handled by a professional debt collector, the higher the chances of recovery. The information you provide the agency, such as the resident’s previous addresses, emergency contacts and banking information, is more valuable and accurate within the first 90 days of placement and increases the ability of outside legal counsel to obtain a judgment or file garnishments (where permitted by law) on your behalf.

As a rule of thumb, all eviction and skip accounts should be immediately sent to collections. It’s safe to say that if the property manager was unable to collect while the resident was residing in the community, it’s even more unlikely the manager will be able to collect after the resident departs. If a resident completed a lease, had an insufficient security deposit and left with a balance due, such accounts should be sent to collections within 30 days post move-out. If a resident fails to complete the full term of the lease and breaks the lease without negotiating an early-termination fee or sublease, the property may “accelerate the rent” until a new resident moves in. This action leaves the previous resident owing months of rent and balances that often exceed $5,000. Waiting 60 days before sending the account to collections will allow the property to try to fill the unit. Certain states have laws against accelerating rent, so it’s important to work with an attorney or collection agency that can help you identify these states (and accommodate incremental balance adjustments each month until the full amount is posted and/or paid).

Phase V: Recovery Expectations

The ability to collect past-due monies can vary based on several factors, including consumer credit quality at move-out, average balance due, geographic location, damage policies, quality of supporting documentation, use of software integration and age of the account.

Timing is one of the most significant factors in recovery. The Association of Credit and Collection Professionals states that for every 30 days an account remains unworked, the amount due is 16 percent less likely to be collected. Although the appropriate time to place an account for collection can vary, there’s no benefit to inactivity. Taking action and defining specific next steps ensures no time is wasted.

Length of time and volume of consistent file placement are factors in recovery expectations. The length of time a collection agency has to collect on accounts impacts the appearance of results and collectability potential. If you are utilizing a new agency, you should take into consideration the length of time to collect on accounts when evaluating recovery reports. On average, it takes six to twelve months before a community is stabilized and can start to gauge the overall performance of an agency.

Liquidation rates are the most common measurement of collection performance. In contrast to collections liquidation rates in other industries, such as credit-card or bank-account charge-offs, rental housing debts tend to have lower recovery rates, meaning the ability of the previous resident to repay and the quality of documentation are lower and the account balance higher.

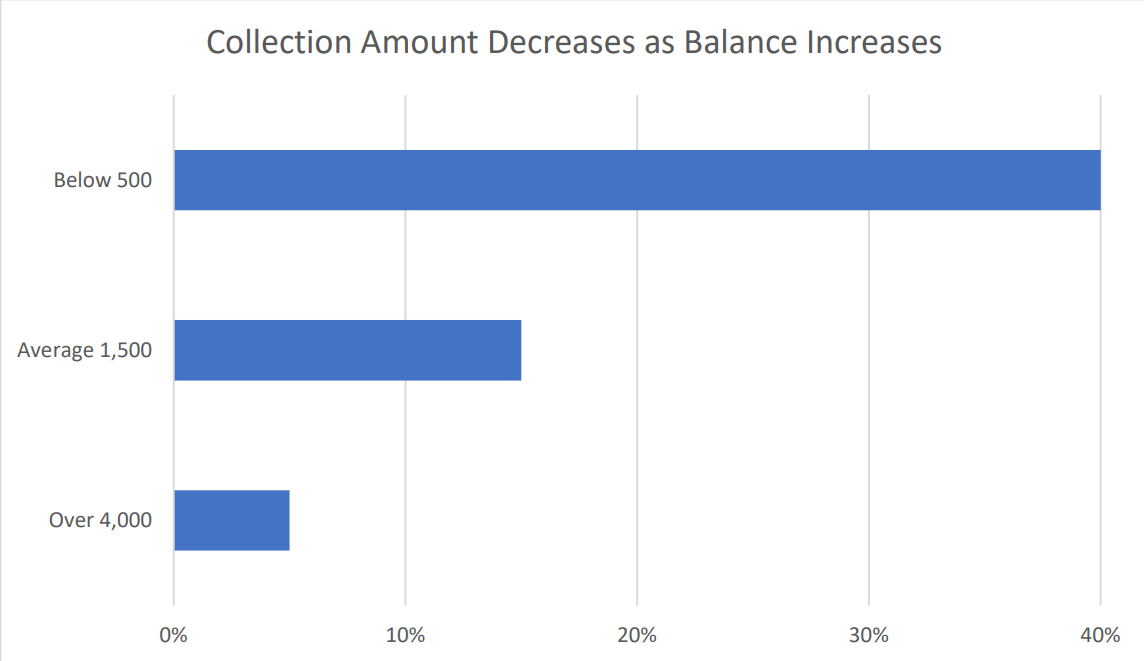

Historically, the most relative variable in recovery is balance. Decades of data have proven that the higher the balance, the less money is ultimately collected (see graphic below). Many times, additional fees and charges are what drive up the balance. Although accelerated rent and large lease-break fees may make sense legally, they may not always yield the best financial return.

Phase VI: Improving Results

It’s a common belief that there’s a handoff of responsibility from the owner/manager to the agency or attorney at time of placement. This is true regarding ownership of outbound attempts to collect; however, both the owner/manager and the agency must work together as a team to consistently improve the collection results.

Here are some topics to consider:

As discussed earlier, the resident application is the first significant milestone influencing recovery. Agencies typically recover up to three times better from prior residents who have provided all necessary information (Social Security number, date of birth, driver’s license) than from those who haven’t provided all this data. Reviewing your community’s current application criteria can have a significant impact on your recovery efforts.

As a rule of thumb, these are best obtained at renewal time. You can also gather new or updated information when residents call in a service request, email the property or visit the office. With residents who’ve lived at the community for years, it’s not uncommon for the majority of their information to have become outdated.

If you’re contacted by a former resident who’s been placed for collections, discuss with your agency how to handle the case. Consumers can attempt to discredit the owner/manager or agency by using one against the other. Work as a team, be involved and share all correspondence. Above all, trust your partner and stay in continual communication with one another.

During the collections process, your agency or attorney will require assistance at times—sometimes to gain clarity about an issue but most often to meet government regulations. In most cases, in such instances collection efforts will remain on hold, so the more quickly you respond to the inquiry, the more quickly your agency or attorney can return to the account and recover your money.

Before the resident moves out, be sure you’re confident the individual understands what’s being charged and why. When a misunderstanding occurs, most instances will result in a dispute and nonpayment. Note that there’s a difference between understanding and agreement: The prior resident doesn’t have to agree with your position but should understand it. As an example, consumers often mistakenly believe their debt is satisfied once they pay a termination fee. A clear explanation of this charge and how it’s applied can help prevent such a misunderstanding.

Don’t assume all the information you’ve gathered is reaching your agency or attorney. Important information should be recorded in your property management software for transmittal if the program is integrated with your attorney/agency. All related documentation should be provided early in the process to reduce delays and increase recovery.

When partnering with an attorney or collection agency, you should expect four standard operating practices:

-

Professionalism:Your agency should be professional at all times when working with former residents; the agency represents your brand and should accurately reflect your company’s values.

-

Transparency: Your agency should provide routine reports that are transparent with key performance indicators that allow management to translate data into actionable insight. Such reports may include current status of each account, net revenue collected and analysis of collections by region to include addresses and demographics.

-

Effective collections management: The agency should provide key performance indicators that property managers can employ for effective collections management. Customer service should be a priority with your agency, to both you as the client and previous residents.

-

Payment: Your agency should handle all payment processing and monitoring.

Sources & Additional Resources

- The Association of Credit and Collection Professionals (ACA International)

- Assurant Recovery Services, Michael Gulbranson, Vice President

- BetterNOI, Jason Montgomery, Vice President of Sales

- FCO (Fair Collections & Outsourcing Inc.), Jay Harris, Esq., Vice President, 877-324-7265

- Greystar, Nikki Paepule, Director, Receivables and Screening Departments

- Hunter Warfield Inc., Tracy Legg, Vice President of Business Development, 813-283-4682

- National Credit Systems, Rick Ragsdale, Vice President of Sales, 800-367-1050

- RentDebt Automated Collections LLC, Laura V. Cameron, CAS, Vice President of Sales, 800-810-2020