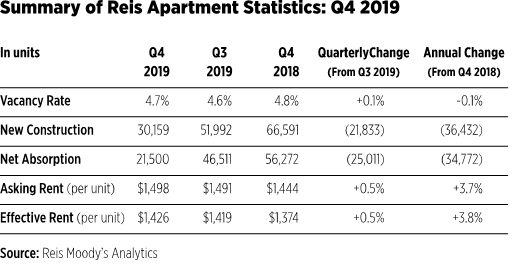

The apartment vacancy rate increased 0.1 percent to 4.7 percent in the fourth quarter, according to REIS Moody’s Analytics. It was 4.8 percent in the fourth quarter of 2018 and 4.6 percent at year-end 2017.

Both the national average asking rent and effective rent, which nets out property manager concessions, increased 0.5 percent in the fourth quarter. At $1,498 per unit (asking) and $1,426 per unit (effective), the average rents have increased 3.7 percent and 3.8 percent, respectively, from the fourth quarter of 2018. This was the lowest annual growth rate in more than two years.

Net absorption also fell quarter over quarter. The 21,500 units absorbed in Q4 was lower than the 46,511 units absorbed in the previous quarter. Likewise, construction was 30,159 units, which was lower than the 51,992 completions in the third quarter. With new completions of 176,565 units in 2019, overall apartment supply growth fell well short of 2018’s 265,041 units. Likewise, net absorption of 177,599 units in 2019 fell short of the 2018 total of 235,786 units.

Vacancy increased in 35 of 79 metros in the quarter after rising in only 23 metros the previous quarter. Occupancy growth was strong in a few metros, particularly in Florida and California. For the year, 23 metros have higher vacancy, and only one (New Haven) shows a decline in rent. Those with the highest vacancy rate increase include Fairfield county, Charlotte, Greensboro/Winston-Salem, New Haven and Dallas. Metros that saw the biggest decline in vacancy include Fort Lauderdale, Jacksonville, Washington D.C., Oakland, and San Bernardino/Riverside.

The metro-level rent growth picture was mixed. Fourteen metros saw an increase in effective rent of 1.0 percent or more, led by Charleston, Chattanooga, Tucson, Pittsburgh and Phoenix—all of which had rent growth of 1.3 percent to 1.9 percent in the fourth quarter. Four metros posted an effective rent decline in the quarter, including Fairfield County, New Haven, Richmond and Northern New Jersey.