U.S. Apartment Market

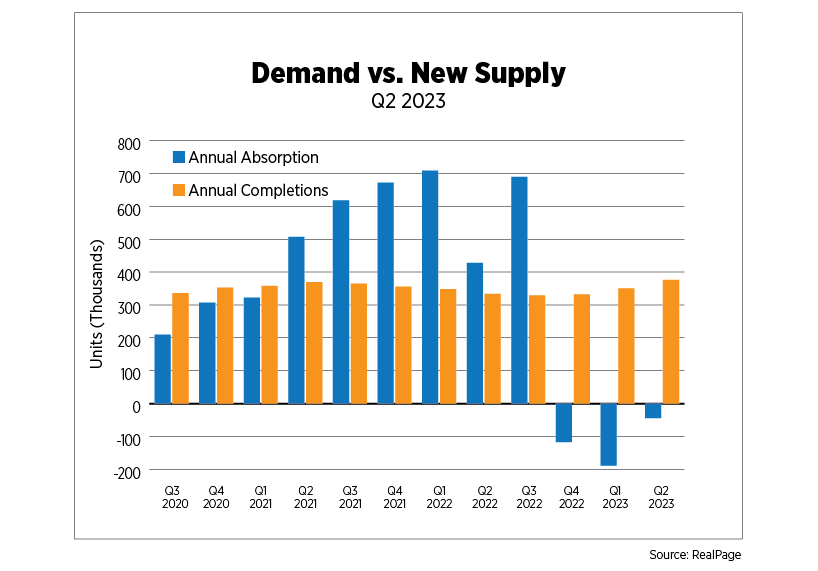

Some promising signs emerged in the apartment market during Q2 2023. Although still running slightly negative on an annual basis, quarterly absorption reached a five-quarter high at approximately 83,000 units, according to RealPage. It was not enough to offset new quarterly completions, however, which totaled 107,000 units (an annual rate of 376,000) and likely won’t be in the near term, with upward of 1 million units currently under construction.

U.S. Census Bureau data revealed a downward trend in permitting activity. Permits have declined for three consecutive quarters, averaging 534,000 seasonally-adjusted annual units in Q2, down from a peak of 670,000 in Q3 2022. Starts appear to be leveling off, averaging 517,000 units, but remain elevated, as do the number of permits authorized but not started. Construction completions averaged 478,000 units for the quarter, the highest level since 1987. It's important to note that the “Census Survey of Construction” is a volatile data series and subject to large revisions. However, the general direction in permits is a result of a combination of soaring financing costs, difficulty obtaining construction loans, elevated levels of new supply in some markets and lingering economic uncertainty.

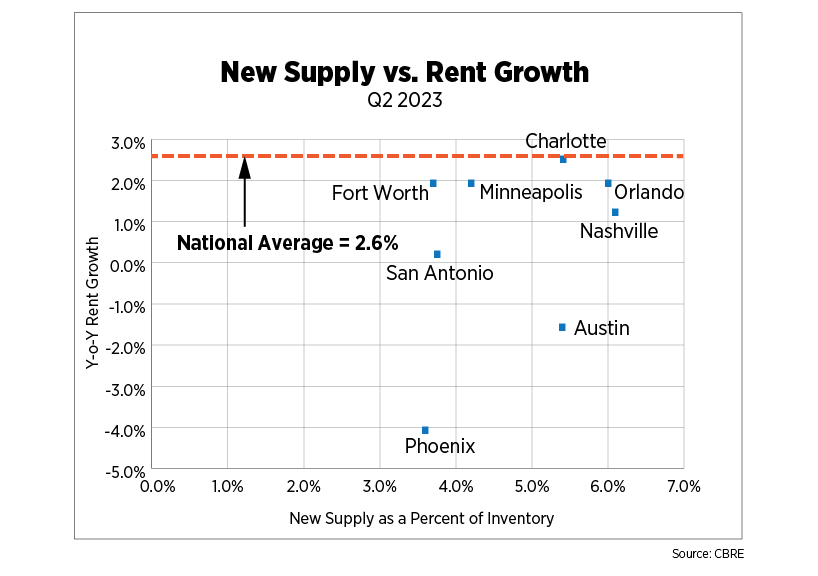

New supply is weighing on market fundamentals, although the magnitude varies widely. The chart below shows CBRE's top markets for new completions for the four quarters ending Q2 2023, measured as a percent of existing inventory. Nationwide, long-term averages for new supply additions were in the 2%-3% range. All these markets are experiencing rent growth below the national average of 2.6% year-over-year, and Phoenix and Austin, Texas, have turned negative. Rent growth can be expected to decelerate further in these and other markets with higher levels of new construction.

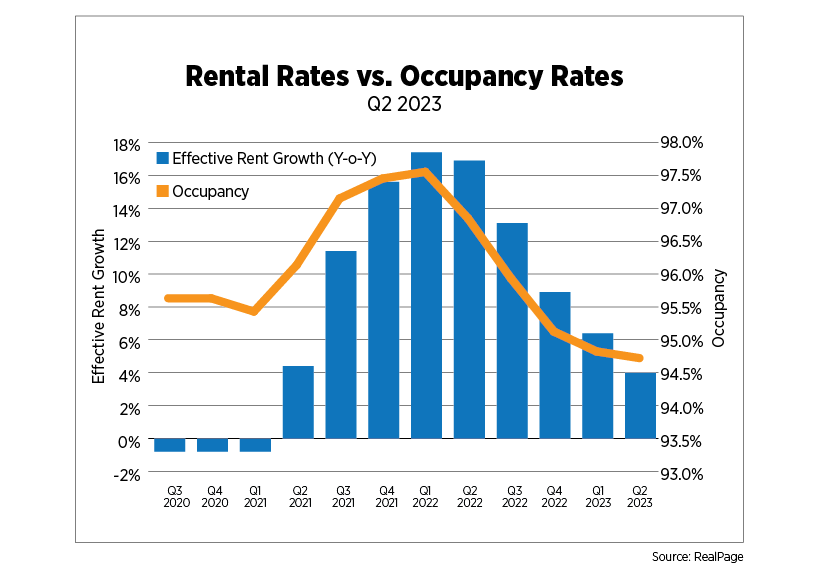

On a national level, RealPage recorded rent growth of 4.0% year-over-year in Q2 2023, marking the fifth consecutive quarter of deceleration. On a monthly basis, rent growth is still falling behind pre-COVID averages, but has been positive all year. Apartment List, however, reported a decline in rents year-over-year for the month of July for the first time since the early months of the pandemic.

Occupancy levels continued to decrease, but the rate of decline has been moderating. The national occupancy rate dropped by just 10 basis points this quarter compared to 70-90 basis-point dips in the last three quarters of 2022.

U.S. Capital Markets

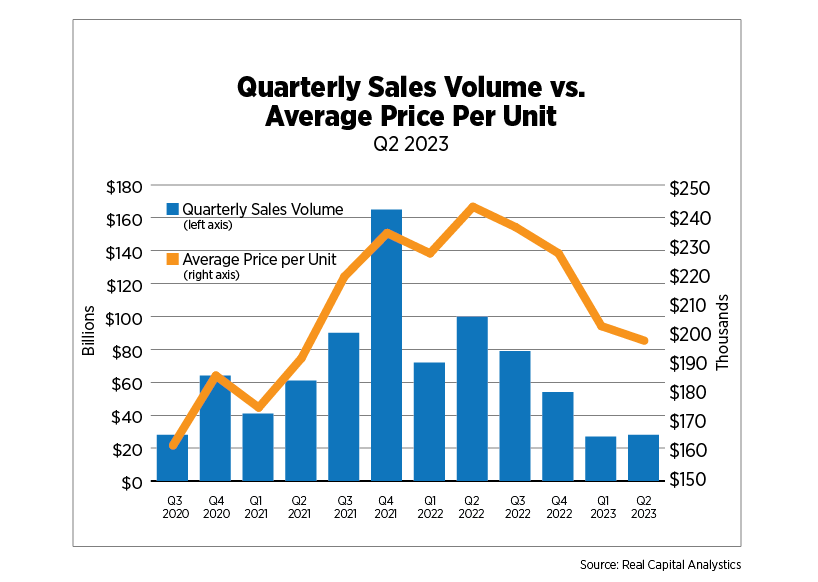

Transaction volumes remained depressed and, unsurprising given Q2 2022's high level of activity were down more than 70% as reported by Real Capital Analytics. With operating and financing costs skyrocketing, and price discovery still underway, acquisitions have been put on the back burner. There is some anecdotal evidence that transactions could pick up by the end of the year, but that will largely depend on the trajectory of the economy, if interest rates level off and if the gap between buyer and seller price expectation starts to narrow.

The average price per unit dropped 19.2% from Q2 2022. The RCA Commercial Property Price Index for apartments experienced the largest reduction of all property types, down 11.7% year-over-year. Cap rates continued to increase and are now up 63 basis points since the 4.6% trough in Q2 2022.

Only three markets experienced an increase in transaction volumes. San Francisco's 65% rise was mainly due to two portfolio sales. A megadeal in the D.C. suburbs led to a 64% increase in transaction volumes in the metro area while the Vespaio, built in 2019 in downtown San Jose, Calif., sold for $515,000 per unit, contributing to sales volumes more than doubling compared to Q2 2022.

U.S. Build-to-Rent Market

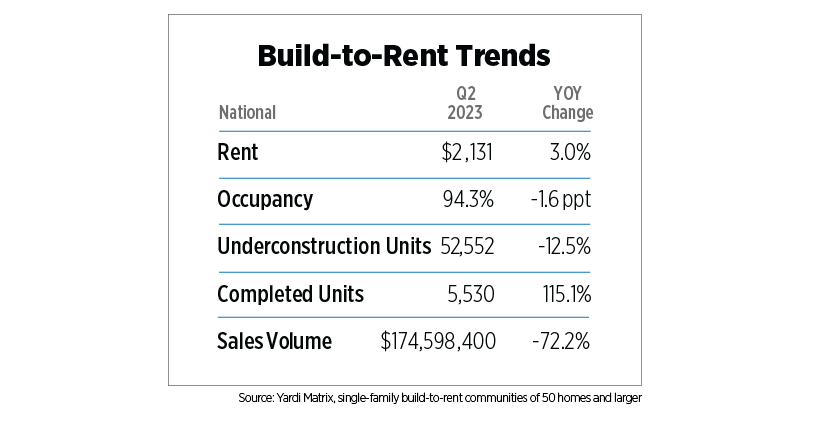

Occupancy rates for the build-to-rent (BTR) market, as reported by Yardi Matrix, continued to drop from a peak of 97% in Q3 2021 to 94.3%. As was the case with apartments, the decline was only 10 basis points this quarter, compared to 40- to 60-basis point decreases in the prior five quarters. Rent growth is back to more sustainable levels, up 3.0% year-over-year. For context, during the five-year period before the pandemic, rent growth averaged 2.8%.

More than 5,500 units were delivered, a record high since the data series began in 2011. Markets with the most additions included Phoenix (785 units), suburban Atlanta (689 units), Pensacola, Fla., (354 units) and Charleston, S.C. (305 units).

As expected, transaction volumes have plummeted compared to last year's extremely elevated levels. Interest rates, economic uncertainty and valuation challenges are plaguing the industry. Some would-be new investors are sitting it out and sticking with conventional apartments until there is more clarity in the BTR market.

Although rent growth at the national level is still steadily increasing, rents are decreasing in several markets and submarkets across the country. The Carolina Research Triangle, Detroit, California's Inland Empire, Miami, west Houston and North Dallas were some of the larger markets witnessing rent declines of 2.5% or more.

U.S. Economy

Recession fears for both businesses and consumers have allayed in recent months for a number of reasons. Inflation is moving in the right direction; wage growth is exceeding consumer price growth; the labor market is as strong as it’s been in over 50 years; and the Fed is at, or nearing, the end of interest rate hikes. Consumer confidence, as measured by both the Conference Board and the University of Michigan, has been trending upward. The National Federation of Independent Business's Small Business Optimism Index showed improvement in some components, but overall, it remained below long-term averages.

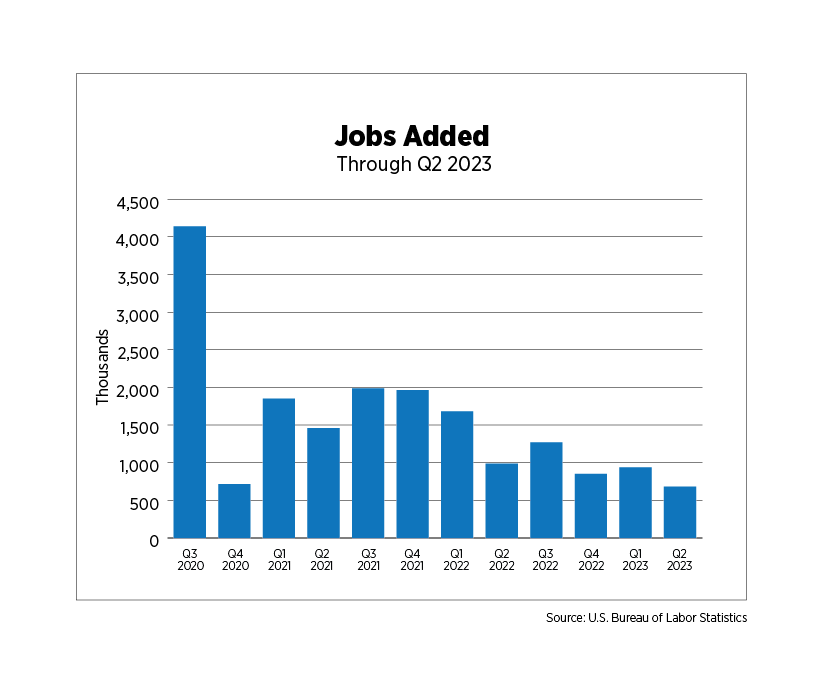

Job growth has been cooling with 683,000 new jobs added in Q2 compared to 937,000 in the prior quarter. July's jobs report, at just 187,000 new jobs, came in below expectations while May and June were revised downward by a total of 49,000 jobs. With a 50+ year low in the unemployment rate persisting in the 3.5% range and layoffs below historical averages, the labor market is behaving exactly as the Fed needs to execute a "soft landing," that is, for the economy to cool enough without sending it into a severe recession. Job openings have also begun to moderate at 9.6 million after peaking at over 12 million in Q1 2022. The quits rate, which averaged 3.9 million this quarter, was at its lowest level in more than two years, signaling that fewer workers are confident in their ability to land another position should they choose to leave their jobs.

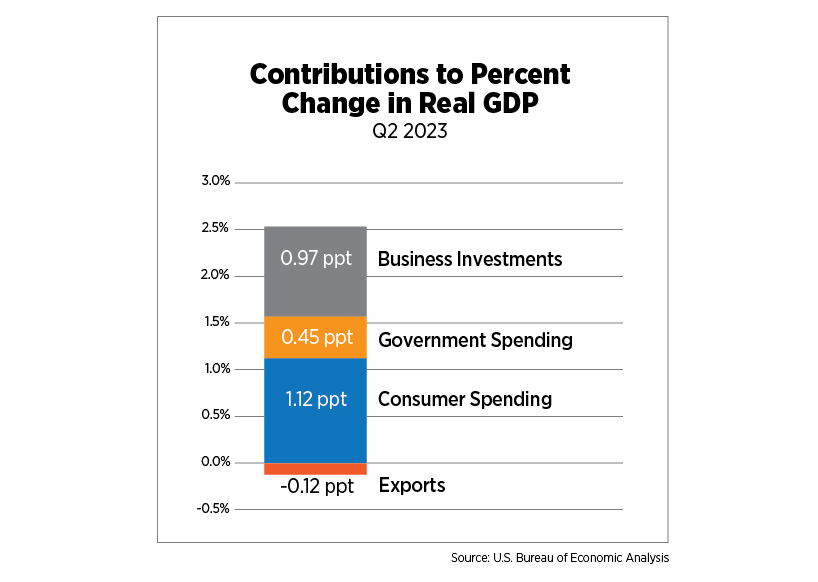

Economic activity was better than expected in Q2 2023, with gross domestic product (GDP) growing by 2.4%. While consumers have been the backbone of expansion during the past several quarters, business investment picked up this quarter--responsible for nearly one percentage point of GDP growth. Businesses investment strengthened in non-residential structures as well as intellectual property, while residential investment was a drag on GDP growth. Forecasts for Q3 GDP are strong, with Moody's Analytics predicting a 4.0% increase, while the Atlanta Fed's GDPNow forecast is currently north of 5.0%.

Outlook

Despite more positive economic forecasts recently emerging, the risk of a downturn remains real, with plenty of headwinds on the horizon. In early August, Moody's cut the ratings of 10 small- to mid-sized banks and added some larger banks to a watchlist for potential downgrade. The high interest rate environment and the extended inversion of the yield curve are eating into profits. The potential for increased capital requirements proposed by the Fed and other regulators is adding more uncertainty to the financial sector.

The possibility of a government shutdown beginning in October is also looming. While the economy has weathered other shutdowns in the past, they were typically short-lived. If the debt ceiling debates last spring were any indication of what could play out with a shutdown, it could certainly last longer.

Finally, millions of Americans will begin to repay student loans this fall; however, the Biden Administration announced that missed payments will not be reported to credit bureaus for a period of one year. Still, those that can and do pay may cut back elsewhere, which could have negative implications for consumer spending.

A steady stream of demand should keep rental housing fundamentals solid for the remainder of the year. Apartments remain a more affordable option in many markets across the country because of elevated mortgage rates (which recently hit a 20+-year high) and a persistently low supply of existing for-sale homes. Steady, if more muted, job growth and better-than-average wage growth also add to the equation. Cost pressures for insurance, property taxes and other operating line items will keep net operating income subdued, however.