Affordability is a complex issue and can be driven by diverse factors including income levels, land and natural resource availability, population growth and housing supply-demand balances, among other issues.

National Apartment Association (NAA) conducted a national survey to better understand factors that impact the new supply of apartments. The survey measured development complexity including the impact of community involvement, construction costs, affordability issues, infrastructure, density and growth restrictions, land supply, environmental restrictions, approval process complexity, political structure complexity and time to develop a new property.

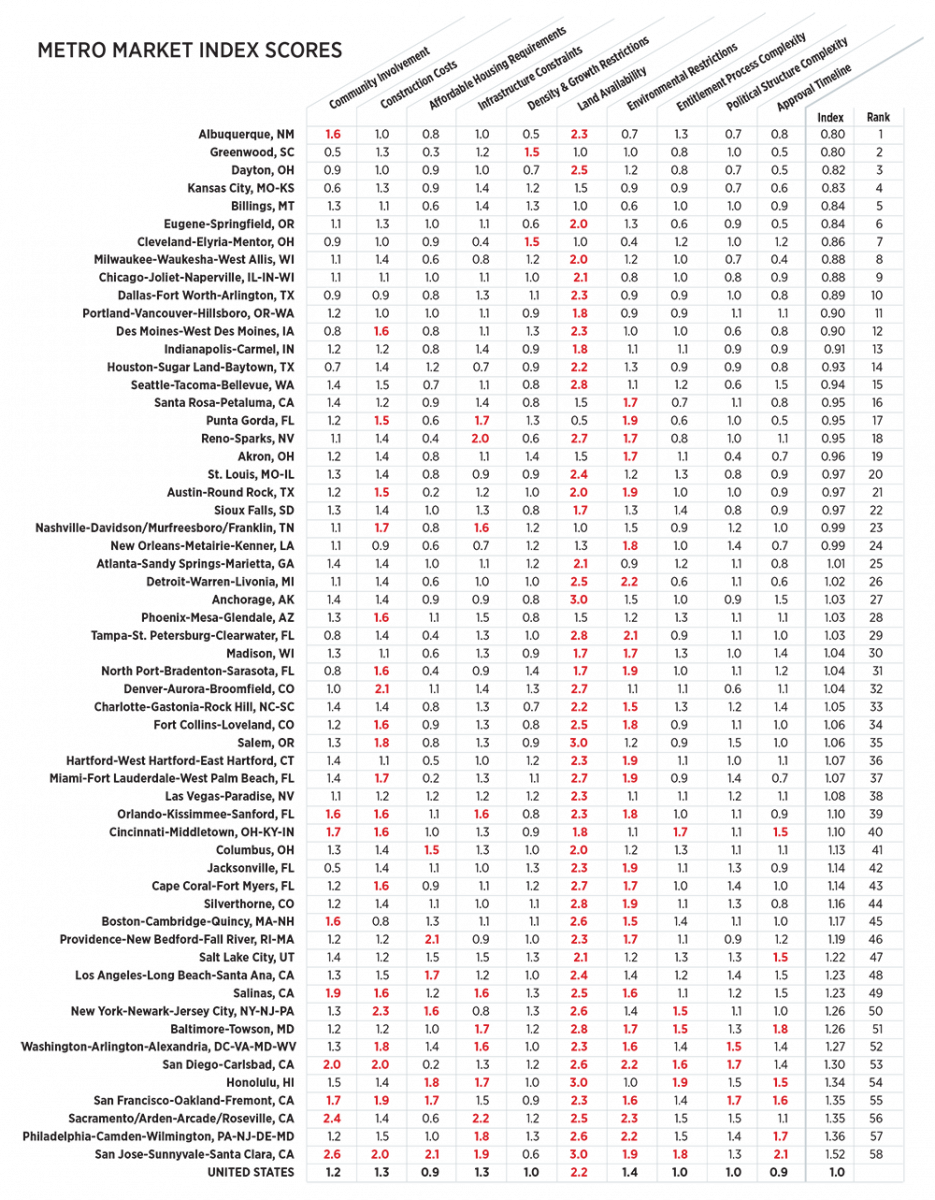

Metro areas are ranked by the relative ease of developing new apartments; however, the intent of this study was to provide data to identify differences in land management and to provide a more holistic and fact-based review of best practices and factors that impact housing availability and affordability. The index rankings are not intended to apply judgment as to whether these policies are either good or bad.

Key takeaways from the survey:

- In addition to the importance of land availability, input from local citizens significantly influences development.

- Rising land and labor costs are inhibiting the production of affordable housing.

- Complex approval systems are correlated to affordability issues.

We hope this report provides facts and focus for local discussions by rental housing advocates, both public and private. The tide of sustained rental demand and challenges to meet this demand must be addressed by those who can influence policies at the local level with cooperation from residents, policymakers and developers toward mutual goals.

National Results

A national survey was sent in October to more than 5,254 private companies and potential respondents from the NAA as well as 37,000 potential respondents from the American Planning Association throughout the United States. The survey remained open through December with clarification and data clean-up in certain markets through early February.

A total of 764 responses were received, including 274 from private companies, including development, property management, consulting or investment firms; 449 from public entities including city, county, township, town, village, borough or planning and economic development agencies; and 31 from other non-governmental agencies and nonprofits. A few responses were removed from the sample for duplicates and incompleteness resulting in a total of 753 responses.

Including 130 responses from the pilot studies, 883 responses in total are included in the final index report. Responses represented 241 metropolitan or micropolitan statistical areas.

Survey respondents were highly experienced in their markets. Three-fourths of respondents have more than 10 years of experience developing or reviewing development projects in their market; 42 percent have 21 or more years of experience; 18 percent have 16 to 20 years of experience and 15 percent have 11 to 15 years of experience; survey respondents work across a wide range of project sizes; 22 percent of survey respondents reported that the typical size of a multifamily development that they review or develop is less than 20 units; 44 percent reported that the typical project size is 100 or more units.

Overall, 40 percent of survey respondents indicate that it is fairly to extremely difficult to get new multifamily residential projects approved for development. Another 31 percent of respondents are neutral; and 29 percent of respondents indicate that it is easy to get new projects approved. For the private sector only, 48 percent said that it is fairly to extremely difficult while 22 percent said that it is reasonable to relatively easy.

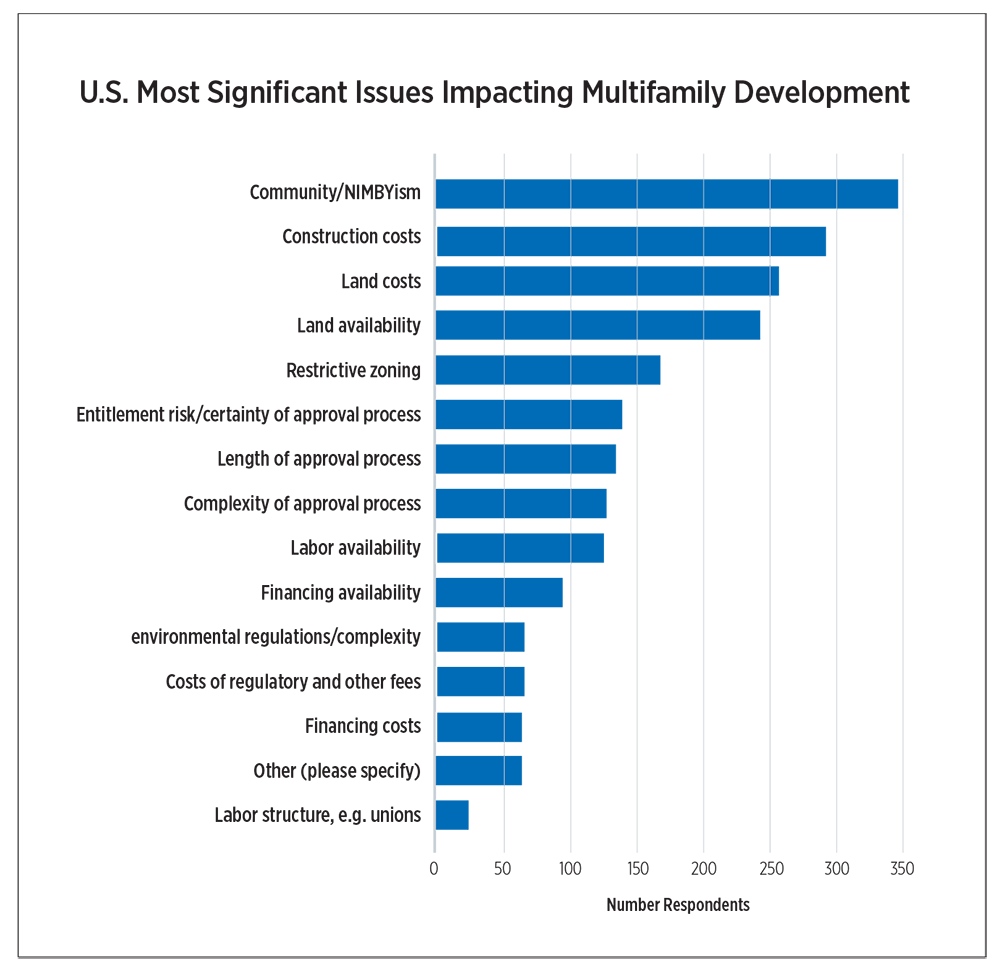

When survey respondents were asked “What are the (one to three) most significant issues affecting multifamily development in your area?” community involvement/NIMBYism was by far the most common response followed by construction costs and land availability and land costs. Interestingly, labor structure, e.g., unions, was ranked least important with less importance also placed on financing costs and availability, environmental regulations and costs of regulatory or other fees. Note however, that some of these issues—especially environmental issues—are ranked as very important for some metropolitan areas. Survey respondents also commonly mentioned in the “Other” category various infrastructure and affordable housing issues.

A total of 91 questions and five external data sources were aggregated into 10subindices based on the 753 responses to the national survey. External data was entered as the U.S. figure or U.S. market average. The U.S. total index averaged to close to 1.0 for each subindex. However, the importance of each question within the subindices varied significantly.

High scores indicate that survey respondents felt that issue is important in influencing multifamily development and/or is prevalent in the market. All questions are scored with 0 as a minimum score and 3 as a maximum score. By far, survey respondents responded that the land development process is a local process that is influenced by local councils (2.40 score) and the local community. Most survey respondents indicated that local resident involvement is important in influencing residential building activities and/or growth (1.95 score) and that citizen opposition to growth/NIMBYism is important in regulating the rate of residential development in their community (1.96 score).

Community meetings are generally required before which any zoning or rezoning requests must be presented (2.11 score). One-third of survey respondents indicated that construction costs including labor, hard and soft costs have increased by more than 20 percent in the past five years; another 45 percent indicated that construction costs are up by 11 percent to 20 percent. Similarly, 30 percent of survey respondents indicated that the cost of undeveloped multifamily land rose by more than 20 percent in the past five years, with 36 percent reporting costs are up by 11 percent to 20 percent.

Fees, studies and other soft costs, however, are not believed to be increasing as quickly as only 10 percent of respondents indicated a 20 percent+ increase in fees, studies and other soft costs during the past five years and 26 percent indicating an 11 percent to 20 percent increase. The most common impact fees noted were sewer and water followed by fees for public facilities or services such as police, fire, libraries and such, then transport, schools and parks.

Overwhelmingly, waivers are not available in place of impact fees (2.30 score). Land costs vary widely and are skewed heavily on the high side. On average for the markets covered in the detailed index, land and permit costs are considered to be approximately 35 percent of total building costs, a significant component and 1.77 index score for the U.S. on average. While the availability of land is considered a very important factor in multifamily development (2.16 score), land topography as indicated by a developability index indicates that land should be plentiful (0.87 score).

Communities frequently use height (1.74 score), density (2.01 score), environmental (1.65 score) and flood zone (1.50 score) restrictions to guide growth. Infrastructure also is commonly listed as an important issue, particularly the availability of infrastructure such as sewer and water capacity or connections to support growth (1.78 score). Traffic issues are also frequently important in regulating the rate of development (1.74 score). Infrastructure improvement fees and mitigation are commonly used (1.53 score).

We touched lightly on the affordable housing issue in this survey, which is a complex topic in and of itself that varies significantly by market. While most markets in the survey do not have rent control measures of any sort in place (0.25 score), we commonly saw rent control mentioned in California markets as well as in the New York metropolitan area. Affordable housing requirements are used slightly more, but also infrequently (0.68 score), and are often seen in California as well as Washington, D.C., and Boston. Density bonuses are sometimes provided if affordable housing is included, but often a bonus is not provided, resulting in a high score of 1.93 for this factor.

A number of markets did indicate the presence of more tenant-favorable restrictions such as requiring just cause to evict a multifamily tenant (1.11 score). At first glance, neither process nor political structure complexity issues generally rank highly as important factors in influencing multifamily development at the U.S. level. However, as mentioned previously, the regulation process is complex and varies widely, and these factors are likely to be “averaging out” important variations between markets. Many markets have by-right processes that allow a fast-track review process for projects that meet guidelines (1.66 score). For the most part, markets indicated no change in the time required to complete the review and approval of residential projects (1.46 score for projects that are less than 50 units and 1.57 score for projects that are larger than 50 units.) Markets such as San Jose, Seattle, Philadelphia, Phoenix and Salt Lake City did indicate a significant amount of city council opposition to growth (scores of 2 to 2.5).

Metro Area Results

We received enough responses to calculate market level indices for 58 markets. To be included in the following metro market table, the market needs to have a minimum of two responses that are not widely varied in response. While several markets have more than two responses, they were not included in the following individual index calculation tables because the responses were either incomplete, varied widely or only represented a certain municipality within a larger metro area and were not representative of the broader market.

The table represents a wide variety of markets ranging in population size from 29,000 in the Silverthorne, Colo., micropolitan statistical area to more than 20 million in the New York metropolitan area.

View Markets Least Resistant To Development