Two chief economists and one high-level apartment marketer and pricing analyst walk onto a stage.

No, this isn’t the start of a bad joke, this was “Rentonomics 101: Understanding Trends that Are Powering the Future of Renting” at NAA’s Apartmentalize. Together, the panelists discussed who the new renter is, how amenities need to change to meet new renter demand, government involvement and their predictions for the future of renting.

“The multifamily housing industry is more dynamic and more diverse than ever before,” said Igor Popov, Ph.D., Chief Economist for Apartment List. “Seniors are entering at 40 percent and high-income renters have been growing at almost

50 percent.”

Adding to that dynamic is that renting no longer carries a negative stigma, says Jennifer Staciokas, Senior Vice President of Marketing, Training and Pricing for Pinnacle. Citing a New York Times article, Millennials like that they rent. It is becoming the option of choice, she said.

Delivering Choice & Mobility

Choice and mobility were common themes throughout the conversation with much of the discussion evaluating how the subscription economy plays into both.

“It’s sexy to not own anything and not be tied down to anything,” Staciokas said. “This new generation saw their families lose their housing and clothing. They want it and enjoy it but they don’t want to have to buy it.”

The new face of renters is that of people who value experience. The value of an experience is more important to them then the limited time that they may own something. For example, going on a sky-diving trip and having that experience is more valuable than spending the same amount on a new phone or a great jacket – something that they will either give away one day or that will get too small or break.

Popov sees things differently. He believes the gig mindset is simply a trend for those just out of college and not necessarily a long-term change.

“As an economist, how is subscription going to translate into wealth,” he challenged. “Is there a third category in rent vs own vs something else? A flexible or investment model that offers economic mobility? How do we generate the ability to create choices?”

Chief Economist for the City and County of Denver Jeff Romine affirms that choice is still very much a part of the renter lifestyle as evident by “18-hour cities.” People are still choosing to live in urban environments because cities are alive from 6 a.m. to midnight. Work hours are now different but desires to have the same amenities and services that you would from 8 a.m. to 5 p.m. is still very important, he said. The subscription economy fits into the ability to deliver these services and amenities.

The New New-Amenity Game

Rental housing operators have been escalating the amenities war for years. As the renter demographic evolves, the amenities race ramps up, as well. Panelists discussed ways to offer choice and mobility in targeted services and amenities.

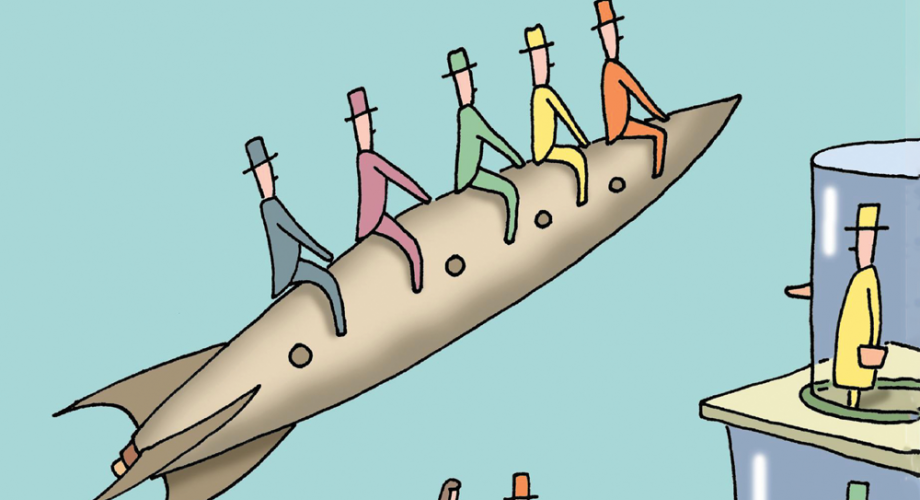

Staciokas suggests focusing on amenities that can be adapted and repurposed. Parking is a great opportunity to create a physical activity in those areas. Similar to The Related Companies and its recent partnership with Uber Air. Related Companies will be Uber Air’s preferred development partner supporting its Uber Air network in the United States, according to Uber Air’s press release. As part of this partnership, Uber and Related have collaborated on a vision for a future skyport at Related’s 240-acre Santa Clara development to illustrate the benefits aerial ridesharing could provide for the Bay Area and other cities in the future.

Since 2016, Uber Elevate has been working with government and industry stakeholders to create the world’s first aerial rideshare network with safe, quiet and electric Uber Air vehicles that would transport tens of thousands of people across cities for the same price as an UberX trip of the same distance. Uber’s first U.S. Uber Air cities will be Dallas-Fort Worth/Frisco and Los Angeles with a goal of holding flight demonstrations in 2020 and making aerial ridesharing commercially available to riders in 2023.

“Consider what else might be coming in the future—such as drone delivery—and determine how can you prepare your building now for that future trend,” Staciokas said.

“Where is your transportation hub,” challenged Romine. “There are so many choices that exist now between rideshares, scooters, and bikes. People (and residents) are getting tired of an Uber driver stopping in the middle of the street,” he said. “It is important to address this at the property level.”

There was one unexpected prediction about amenities from Popov who asked operators when the industry can match interesting demand with interesting supply. Will renters pay more for cannabis-friendly buildings or an Airbnb-friendly building? Even onsite daycare and a huge playground in the middle of a community. People will be willing to pay more for these types of amenities, he predicted.

Government Involvement

Rent control, ADA compliance and vacancy tax are all government regulations that are shifting in the industry.

In Denver specifically, it is a relatively balanced market with rental housing only slightly higher than that of single-family. However, there is a shortage of 25,000 apartment homes for affordability, which represents a significant gap. Romine questioned the idea of rent control, arguing there must be another way to make it better.

“Innovation in the marketplace needs to be done hand-in-hand with government,” he urged. “There needs to be flexibility to meet the market demand. Maybe that comes in a property that is a split hotel or an apartment building that is operating as a hotel with the ability to adjust its rental units and short-term availability as market demands shift.”

The Next 10 Years

So, what do two chief economists and one marketing and pricing analyst have to say about what big predictions are in store for the future of renting?

Popov predicts ownership and renting will become more feasible through financial technology. There will be a much better way to be flexible for investing but still rent.

Staciokas predicts there will be more self-sustaining pods as they require less time to build and save on water and energy consumption. More important though, she predicts the face of who owns rental properties will be completely different, especially as Google, Microsoft, Facebook and even colleges and universities become rental property owners.

Romine believes a full evolution of transportation is on the horizon. The onset of driverless cars is not that far away, and cities are going to see a lot of difference in mobility.